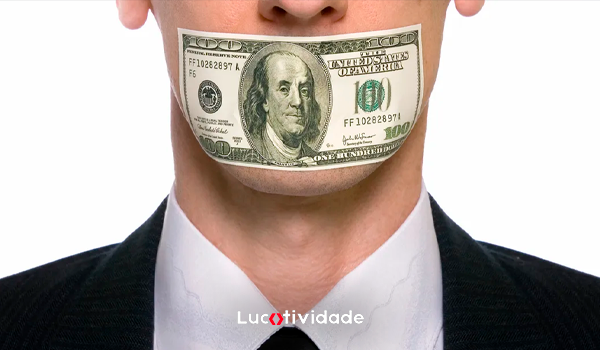

Why We Avoid Talking About Money

For many, discussing finances feels uncomfortable—even taboo. Cultural norms, upbringing, and personal insecurities make conversations about money charged with emotion. People may fear being judged for earning too little, spending too much, or simply not knowing enough. This discomfort often leads to avoidance, which creates more confusion and tension over time.

Avoidance doesn’t just delay decisions—it can deepen financial misunderstandings. Partners may assume they’re aligned when they aren’t. Friends might overextend themselves trying to keep up. Colleagues may hesitate to discuss salary, perpetuating income inequality.

Consequences in Personal Relationships

Financial silence within marriages or partnerships can lead to resentment and broken trust. Without open dialogue, one person may feel burdened by debt while the other remains unaware. Hidden purchases, secret accounts, or differing saving styles can result in what some experts call “financial infidelity.”

Clear and consistent communication builds transparency. That doesn’t mean sharing every receipt—but it does require aligned goals, mutual respect, and frequent check-ins. Couples who plan budgets together and openly discuss financial values report stronger relationships and better financial outcomes.

Money Talks with Family and Friends

Family dynamics often complicate financial conversations. Adult children may feel guilty asking parents about estate plans, while siblings might clash over inheritance or caregiving costs. Meanwhile, among friends, discussions about splitting bills, lending money, or lifestyle differences can become quietly contentious.

Being honest and proactive can ease discomfort:

- Use “I” statements to express concerns without blame

- Set boundaries before lending or borrowing

- Be clear about expectations around shared expenses

At Work: Silence Can Cost You

Avoiding money conversations in professional settings—especially around salaries, raises, or freelance rates—can result in underpayment and missed opportunities. While it’s important to navigate these talks tactfully, staying quiet out of fear or politeness can limit your earning potential.

Normalize the conversation by doing research, practicing negotiation scripts, and seeking out mentors who talk openly about money. Collective awareness strengthens everyone’s position.

Open financial communication isn’t just a skill—it’s a necessity. Whether at home, among friends, or in your career, the ability to speak clearly and kindly about money can protect relationships, reveal hidden challenges, and create stronger financial foundations for the future.

From Paycheck to Portfolio: Turning Active Income into Passive Power <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Transforming your earnings into long-term wealth is less about how much you make—and more about how well you redirect it.</p>

From Paycheck to Portfolio: Turning Active Income into Passive Power <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Transforming your earnings into long-term wealth is less about how much you make—and more about how well you redirect it.</p>  Why Financial Comparison Is Costing You More Than You Think <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>When measuring your money against others, you risk more than just envy—you risk your future.</p>

Why Financial Comparison Is Costing You More Than You Think <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>When measuring your money against others, you risk more than just envy—you risk your future.</p>  How Overthinking Your Finances Can Hurt More Than Help <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Sometimes, trying to be too careful with money ends up doing more harm than good.</p>

How Overthinking Your Finances Can Hurt More Than Help <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Sometimes, trying to be too careful with money ends up doing more harm than good.</p>